STANDARD LIFE: HELP WHEN IT MATTERS MOST

Nomination

Category

Client of the Year - Design

Company

Standard Life

Summary

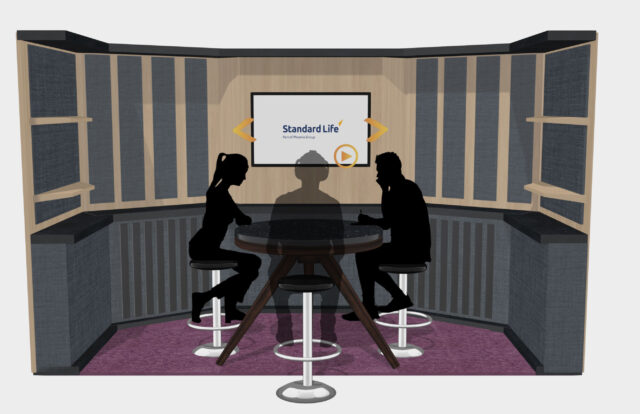

Many people, through the COVID pandemic and the recent cost of living deterioration, have seen their vulnerability (as categorised by the Financial Conduct Authority) increase and are not getting the support and guidance they need to make good financial decisions. As one of the UK’s leading Pensions and Savings providers, Standard Life has responded with the creation of a specialist Vulnerable Customer Team and the design of the Helping Hand Programme which specifically caters to the needs of vulnerable customers. This award-winning team are extensively trained in how to recognise the range of possible vulnerabilities across their customers and how to deal with each in an empathetic, practical, and positive way. Standard Life’s brief was to bring to vivid life their Helping Hand Programme so that existing and prospective clients could witness first-hand the depth of specialist support available to their members. Our film leverages the power of VR to bring to life the vital work that the Vulnerable Customer Team undertakes. Through immersive and emotive story-telling this VR content provides a deep level of engagement for a variety of audience groups that include clients, industry stakeholders and colleagues, in each case leaving a lasting and meaningful impression with the viewer.